A Presidential Pivot on a Steel Deal

President Donald Trump has thrust the fate of United States Steel Corporation back into the spotlight. On April 7, 2025, he issued a memorandum directing the Committee on Foreign Investment in the United States (CFIUS) to reassess the proposed acquisition of U.S. Steel by Japan’s Nippon Steel Corporation. This move revisits a decision made by his predecessor, President Joe Biden, who blocked the $14.9 billion deal in January 2025, citing national security risks. Trump’s order signals a potential shift in how the U.S. balances economic growth with safeguarding critical industries.

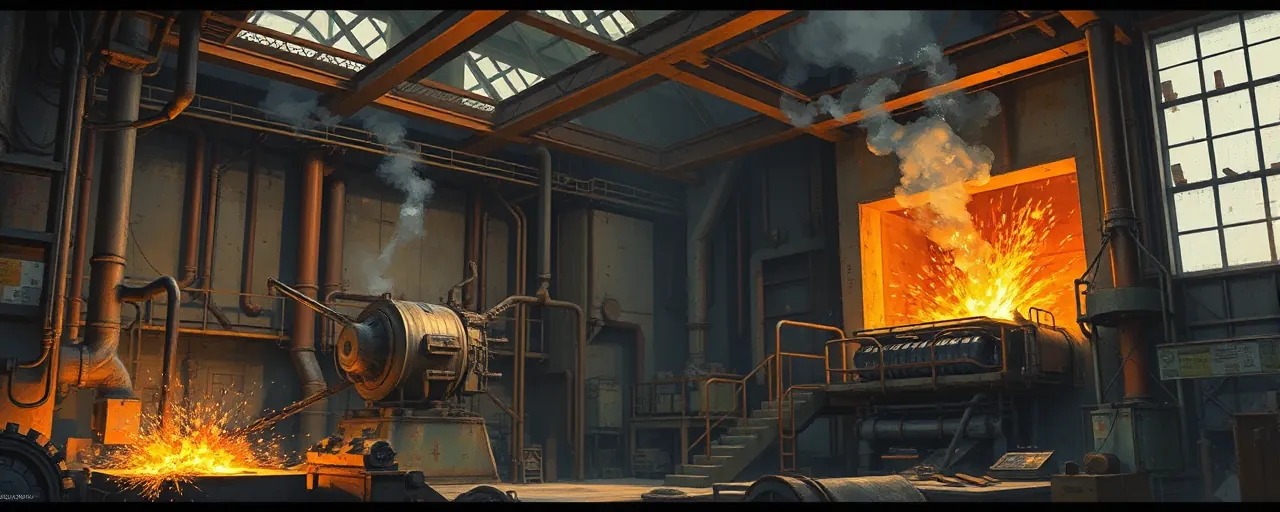

The stakes are high for workers, shareholders, and international allies alike. Nippon Steel had promised $2.7 billion to modernize U.S. Steel’s aging plants and a decade without layoffs, offering a lifeline to an industry battered by global competition. Yet Biden’s rejection left those plans in limbo, prompting questions about the future of American steelmaking. Trump’s directive now asks CFIUS to take a fresh look, leaving open the possibility of reversing course or doubling down on protectionism.

Jobs, Plants, and the Price of Steel

At the heart of this saga lies a tangle of economic consequences. U.S. Steel, a storied name in American industry, has struggled to keep pace with foreign rivals like China, whose state-backed producers flood markets with cheap steel. Nippon’s investment could have upgraded facilities, boosted efficiency, and secured jobs in states like Pennsylvania and Indiana. Without it, the company faces an uphill battle to fund its own modernization, potentially leading to plant closures or lost wages. Shareholders, meanwhile, saw a $3.5 billion premium vanish when Biden halted the deal.

The ripple effects extend beyond steelworkers. Manufacturers relying on domestic steel, from automakers to construction firms, could face higher costs if U.S. Steel’s output falters. Some economists warn that blocking foreign investment might deter other companies from betting on the U.S., shrinking the pool of capital needed to keep industries competitive. Others argue that preserving domestic ownership outweighs those risks, ensuring control over a vital supply chain in an unpredictable world.

An Ally Under the Microscope

The review also puts U.S.-Japan relations under strain. Japan, a steadfast ally hosting over 50,000 American troops, has long been a partner in countering China’s regional clout. Nippon Steel framed its bid as a vote of confidence in the U.S. economy, aligning with Japan’s push to deepen investment ties, projected to hit $1 trillion. Yet Biden’s decision, echoed now by Trump’s scrutiny, suggests even friendly nations face hurdles when eyeing American assets. Trade tensions, including U.S. tariffs on Japanese steel, add another layer of complexity to this dynamic.

Voices on both sides weigh in. Supporters of the block say foreign ownership, even by an ally, risks weakening U.S. leverage over a key resource. They point to hypothetical scenarios, like a trade dispute or global crisis, where domestic control might matter more than alliance ties. Critics counter that Japan’s track record of cooperation, including backing U.S. export controls on China, makes such fears overblown. The debate underscores a broader question: how does the U.S. define security in an interconnected economy?

CFIUS and the Power of Oversight

The CFIUS process lies at the core of Trump’s directive. This multi-agency panel, empowered by the Defense Production Act of 1950 and expanded in 2018, digs into foreign investments to spot risks to national security. Its reviews, typically spanning 45 days with a possible extension, weigh everything from military needs to economic resilience. In this case, Trump has asked for a de novo review, meaning CFIUS starts from scratch, giving U.S. Steel and Nippon Steel a chance to address concerns raised in Biden’s block.

Historically, CFIUS has targeted deals involving adversarial nations, like China’s failed bids for U.S. tech firms. Applying such scrutiny to Japan marks a shift, reflecting worries about supply chains and industrial strength rather than just defense secrets. The outcome hinges on whether the companies can propose fixes, like keeping plants open or limiting foreign control, that satisfy CFIUS’s findings. Within 45 days, the panel’s recommendation will land on Trump’s desk, forcing a call that could reshape the steel sector.

What Comes Next for Steel and Security

Trump’s memorandum sets the stage for a decision with lasting impact. If CFIUS greenlights the deal, U.S. Steel could gain the cash and tech to fend off global rivals, bolstering jobs and output. If it’s blocked again, the company might limp along, raising doubts about America’s ability to sustain its industrial base without foreign help. Either way, the choice will send a signal to investors and allies about where the U.S. draws the line between openness and self-reliance.

For everyday people, this isn’t just about steel beams or trade laws. It’s about whether factories stay humming in small towns, whether cars and bridges cost more to build, and whether the U.S. can trust its friends in a pinch. As CFIUS digs in, the answers will emerge not in abstract policy, but in the real-world fates of workers, businesses, and the ties that bind nations together.