A Surge of Investment Sparks Hope

Factories across America are poised for a comeback. Major companies, including Sanofi, Kraft Heinz, and Carrier, have committed over $24 billion to expand manufacturing and research facilities. These announcements, tied to federal economic priorities, raise hopes for new jobs and revitalized communities. Yet, questions linger about whether these bold pledges will translate into lasting change.

Sanofi plans to invest $20 billion over five years to advance drug production and research. Kraft Heinz is pouring $3 billion into modernizing its plants, marking its largest investment in decades. Carrier’s $1 billion commitment aims to create 4,000 jobs, while Anheuser-Busch and Siemens Healthineers add $450 million to upgrade facilities. This wave of spending reflects a broader push to strengthen U.S. industry.

What’s Driving the Investment Boom?

A mix of policies and global shifts is fueling this surge. Federal tax credits, streamlined regulations, and incentives from the 2022 CHIPS and Science Act and Inflation Reduction Act have made the U.S. a magnet for corporate investment. These measures have drawn $5 in private funds for every public dollar spent. Tariffs on foreign goods have also encouraged firms to bring production back home, with Mexico and Canada gaining as trade partners under the USMCA.

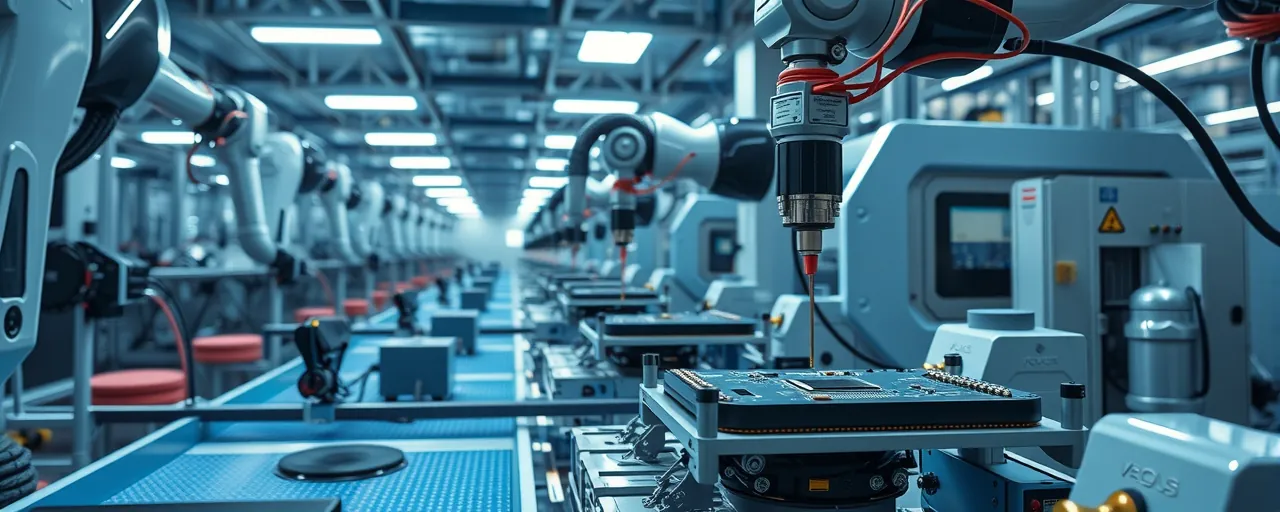

Supply chain disruptions, geopolitical tensions, and rising offshore labor costs have further pushed companies to prioritize local production. In 2024, 80% of large manufacturers planned to relocate operations to North America. This aligns with forecasts of a 4.2% revenue rise in U.S. manufacturing for 2025, driven by demand for semiconductors, biopharma, and automated technologies.

Jobs and Growth: A Bright but Uncertain Future

The numbers grab attention: over $5 trillion in announced investments in early 2025, with projections of 451,000 new jobs. From Apple’s $500 billion manufacturing commitment to TSMC’s $100 billion chip factories, these plans could reshape struggling industrial towns. For workers, the chance to land high-paying roles in AI, clean tech, or biopharma feels like a long-awaited opportunity.

Historical trends, however, suggest tempered expectations. Post-World War II industrial expansions created millions of jobs, but recent corporate pledges have often fallen short. Long construction timelines, automation, and shifting priorities can shrink actual hiring. Analysts stress the need for clear timelines and training to ensure workers benefit from these investments.

Hurdles Threaten the Promise

Despite the optimism, challenges loom. Tariffs, while boosting domestic production, have driven up costs for raw materials, hitting smaller businesses hard. Small business confidence dropped 50% in 2024 amid trade uncertainties, and layoffs spiked in some industries. Corporate leaders, cautious about policy shifts, have postponed major factory plans, raising doubts about the pace of progress.

Some question the authenticity of these pledges, noting that companies may reframe existing budgets as new investments to gain favor. A projected 1.9 million worker shortage in manufacturing by 2035 adds pressure, as automation may reduce the need for human labor. These realities complicate the path to widespread economic gains.

Balancing Policy and Market Forces

Advocates for government-led strategies highlight the success of past initiatives, like the New Deal and recent infrastructure laws, which spurred $196 billion in clean-energy projects and 45,000 jobs from 2022 to 2024. They argue that federal incentives are critical to sustaining investment and securing technological leadership against global rivals.

Others favor a hands-off approach, pointing to the 2017 Tax Cuts and Jobs Act as proof that tax reductions and deregulation can drive innovation without bureaucratic interference. Both perspectives agree on the need for robust investment but diverge on the government’s role in guiding it. Finding a balance will shape the outcome of these efforts.

Will Communities See Real Change?

For towns hungry for economic revival, these investments offer a lifeline. In North Carolina, Johnson & Johnson’s $2 billion biologics facility promises 500 jobs, a potential boost to local wages and businesses. Similar projects could breathe life into fading industrial hubs, but only if they move from announcement to reality with local hiring and sustained impact.

Doubts persist about whether these efforts will rival past industrial booms or stumble under modern constraints. Workers need accessible training to compete for new roles, and communities require transparency on project timelines. Policymakers must navigate fiscal limits while maintaining incentives to keep the momentum alive.

The true measure of this investment wave lies in its impact on everyday lives—paychecks earned, businesses thriving, and towns rebuilt. As companies, workers, and leaders chart this course, the future of America’s industrial heartland hangs in the balance.